After enjoying years of bumper earnings, 2023 has been a challenging year for housebuilders. Another disappointing earnings update from Barratt Developments (LSE: BDEV) highlights the extent of the challenges facing the sector and its shares. So, should I buy some of the stock now while it trades at depressed levels?

Q1 trading update

It isn’t hard to understand why the housing market is so sluggish at the moment. Rocketing mortgage costs and a cost-of-living crisis have put off both buyers and sellers alike.

This continued slowdown is reflected in Barratt’s trading update released on Wednesday (18 October). For the period, net private reservations per average week were 169, down 10%. Reservations per active outlet were down 20%.

Should you invest £1,000 in Barratt Developments right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barratt Developments made the list?

However, it did hold its guidance in relation to total home completions. It expects to deliver between 13,250 and 14,250 homes in FY24.

Mortgage affordability

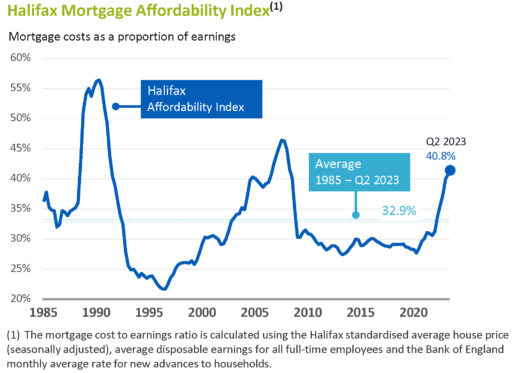

For over a decade, aspiring home buyers benefited from an ultra-low mortgage rate environment. The rapid rise in interest rates witnessed over the past year are clearly beginning to impact affordability.

The following chart shows how mortgage costs as a proportion of earnings have fluctuated over the past 40 years. Earlier this year, they reached nearly 41% of post-tax earnings. This is above the historical average of just over 30%.

Source: Barratt Presentation

Most of the pain inflicted on the housing market can be traced back to the spike in bond yields in September 2022, following the disastrous mini budget. What’s even more concerning though is that, since this chart was published, UK gilts have spiked beyond even those levels.

Changing incentives

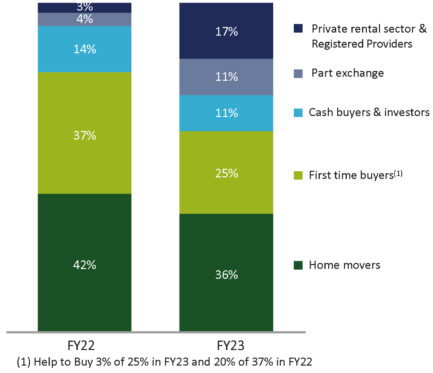

As mortgage rates have increased and the help-to-buy scheme closed its doors in October 2022, Barratt’s private customer reservation mix has drastically changed. This is depicted in the following chart, which shows the emergence of three trends.

Source: Barratt Presentation

First-time buyers, the cornerstone of a healthy housing market, have been hit hard. Particularly notable is the severe drop-off in help-to-buy purchases (see chart legend).

Second, in order to drive sales, it has expanded its part exchange (PX) offering. PX can be a bit of a double-edged sword for housebuilders.

Used appropriately, it can be a very powerful tool in driving sales. After all, it eliminates the thorny issue of the housing chain. But in a falling house price market and/or sluggish sales backdrop, it can be disastrous for profitability.

Third, the business is beginning to drive sales in the private rental sector and through registered providers of social housing. Collectively, these increased from 3% in FY22 to 17% in FY23.

Should I buy?

Underlying housing market fundamentals across the UK remain strong. There remains an acute need for more houses. In addition, undersupply is evident given rent inflation in the private rental sector.

Despite this fact, the ending of the era of cheap debt, I believe, fundamentally alters the dynamics for the whole market.

I’m not expecting a crash anything like that seen in 2008 so I don’t see the shares as a falling knife. But I also don’t expect to see house price inflation take off any time soon, either. For now, the stock remains on my watchlist.